Sharp flood insurance increases are provoking a slow-moving “hurricane” in Louisiana, state lawyers argued Thursday in a high-stakes federal court hearing in New Orleans that could determine the future of sweeping changes to the nation’s system for setting rates.

The day-long hearing was part of a lawsuit filed by Louisiana and nine other states against the federal government over premium increases under the National Flood Insurance Program, which is overseen by FEMA. U.S. Judge Darrel James Papillion of the Eastern District of Louisiana called the complex case “of great public concern” and pledged a ruling as “promptly as possible.”

Papillion, who was nominated to the federal bench by President Joe Biden, is being asked by the states, parishes, municipalities and levee districts filing the suit to issue an injunction and halt the premium changes. The federal government, meanwhile, is calling on him to dismiss the case entirely.

“This is a hurricane,” state Solicitor General Liz Murrill told the court. “It is a slow-moving storm. It is catastrophic in its own right, and we can redress it today. We can stop it from moving further, and we can fix some of the damage and we can make them go back and fix the rest.”

Lawyers for the U.S. Department of Justice argued that the states did not have standing to sue over the issue and had not shown sufficient harm to put a stop to the new program, known as Risk Rating 2.0. They called the claims of widespread ripple effects linked to the premium increases speculation without legal basis and said that, while affordability was important, laws do not require the government to take it into account as the states argue.

“They just have not substantiated that Risk Rating 2.0 premium increases will be so dramatic for such a large population of people that they will be forced to leave their homes and not obtain housing, period,” said Yoseph Desta, one of the federal government’s lawyers.

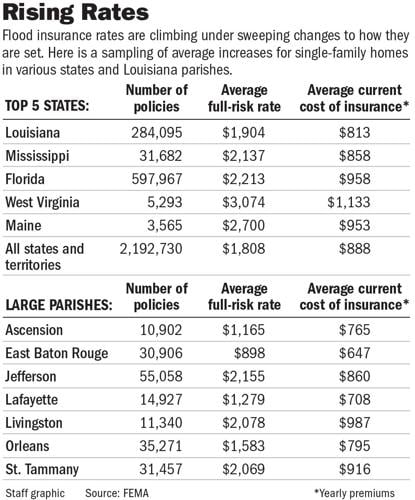

Louisiana has more NFIP policies per capita than any other state and is thus being hit especially hard by the premium hikes. Increases for existing policies are limited to 18% per year by law, but they compound over time and can add up to big numbers.

New policies are priced at the full rates immediately, producing sticker shock for some seeking to buy homes and, according to testimony Thursday, causing a significant number of people to back out of purchases.

Louisiana homeowners were projected to see hikes totaling 134% on average under data released by FEMA in April, though those numbers are evolving based on changes in risk, including climate change, and other factors. Especially flood-prone areas are projected to see far higher increases.

The April data showed the highest projected percentage increase in the nation was Plaquemines Parish's 70082 ZIP code, with average hikes of 1,098%. St. Charles Parish President Matthew Jewell was among the witnesses to testify Thursday, saying the effects there so far included a slowdown in new construction and a loud outcry from residents.

FEMA says the changes make the system fairer for everyone since the new formula weighs the risk of each individual home, doing away with the flawed maps used in the past. That will stop the practice of premiums for pricey beachfront houses effectively being subsidized by those for older, less expensive houses, it says.

Risk Rating 2.0 began for new policies in October 2021 and for renewals starting in April 2022. It calculates premiums through an algorithm that incorporates a list of factors, such as rebuilding cost, distance from water, ground elevation and construction type.

State officials accuse FEMA of a lack of transparency in setting the rates, labelling the algorithm a “black box.” Much of the data being used is proprietary and not available publicly, and FEMA initially only released first-year projections of rate increases, masking the full impact over time.

Testimony on Thursday also came from Casey Tingle, head of the Governor’s Office of Homeland Security and Emergency Preparedness, who described how federal grants can sometimes require homeowners to carry flood insurance. Wendy Thibodeaux, the Lafourche Parish assessor, said she was concerned the new rates would badly affect property values there, suggesting that oil and gas workers living in the parish may be priced out of the market.

Dwayne Bourgeois, executive director of the North Lafourche Levee District, said in his testimony that he did not believe levees and other flood protection measures were being accurately reflected in the new rates.

But while the state’s arguments will likely resonate with many Louisianans, laying out a convincing legal case may pose another challenge. Federal lawyers repeatedly argued that the states were relying on speculation and asserted certain points were simply wrong.

The federal government has already spent more than five years and between $60 and $80 million on Risk Rating 2.0, according to court filings. In addition to more accurately pricing risk, the new system is meant to set the NFIP, currently $20.5 billion in debt, on a more stable financial footing.

“If Risk Rating 2.0 is set aside, what would end up happening is, unfortunately, policyholders in northern Louisiana, who have rate decreases as a result of Risk Rating 2.0 … would go back to subsidizing unfairly policyholders in southern Louisiana and across the country,” said Desta.

The nine other states in the lawsuit are: Florida, Idaho, Kentucky, Mississippi, Montana, North Dakota, South Carolina, Texas and Virginia.